Financial Aid & Scholarships

Navigating college finances can be tricky. With early planning and an understanding of the process of securing the different kinds of money that are available to finance your education, you can alleviate a lot of the stress that so many feel when planning for your post-secondary ventures. Here, you will find a number of resources to help you understand the different types of financial aid that are available and how to navigate the financial aid application process.

Free Application for Financial Aid (FAFSA) and California Dream Act Application (CADAA)

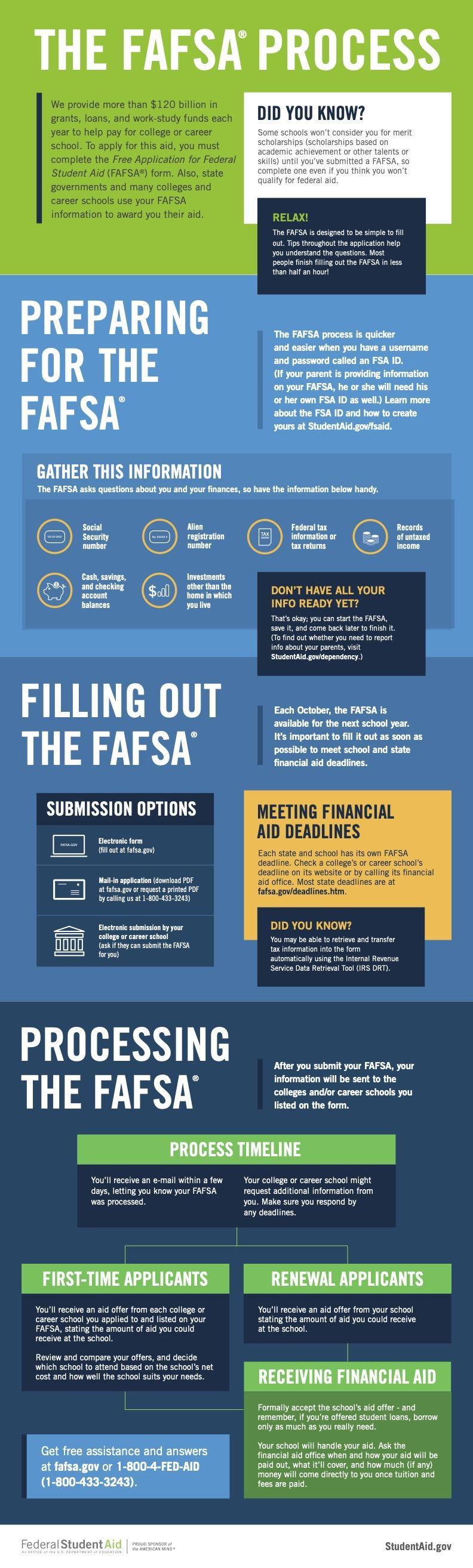

If you will be attending college (2 year or 4 year) or a trade school, you will be completing either the FAFSA or CADAA application. To complete FAFSA both the student and parent(s) will need an FSA ID. Find more information about these applications below.

Scholarships

The vast majority of scholarships do not open until the spring semester. As new scholarship opportunities arise, they will be posted in the daily announcements, "Class of" Google Classroom, and "Senior Seminar" Google Classroom. Here are some websites that you can access to search for scholarship opportunities.

CareerOneStop (Sponsored by the US Dept. of Labor)

College Board Opportunity Scholarships

College Board Scholarship Search

Scholarships for AB 540/DACA/DREAM Students

Local Scholarships

Humboldt Area Foundation (HAF) and Wild Rivers Community Foundation (WRCF) offer over 160 unique, local scholarship opportunities. These scholarships are based on a wide range of criteria such as academics, merit, destination, financial need, and interests.

The universal application for HAF and WRCF scholarships will become available on Friday, January 14th, 2022. Students will be able to apply for multiple HAF/WRCF opportunities through this application.

On the page linked below, in addition to the application link, you can also access tutorial videos to support you with the scholarship application process. There may also be other scholarships available on the HAF website through their partners which are available at different times throughout the year, so check back often!

Grants

Grants are free money that you can be awarded to attend college or some trade programs. To see if you qualify for grants, you will need to complete the FAFSA or CADAA. If you were a foster student for at least 1 day between ages 16-18, you can also apply for the Chafee Grant. There are different types of grants that you may qualify for. They are described below:

State-Specific Grants:

Cal Grant

There are three kinds of Cal Grants - A, B, and C - but you don't have to figure out which one to apply for. You will be considered for these grants based on your FAFSA or CADAA application, your verified Cal Grant GPA, the type of California colleges that are listed on your FAFSA and whether or not you have recently graduated from high school.

Chafee Grant for Foster Youth: If you are or were in California's foster care system, you would receive up to $5,000 annually for career or technical training or college.

University Grants and Scholarships:

State University Grant (SUG): The SUG program provides need-based awards to undergraduate and post baccalaureate students who are California residents or who are otherwise determined as eligible. When you apply for financial aid, you are considered for a SUG by your California State University campus.

Middle Class Scholarship Program: The Middle Class Scholarship (MCS) program provides funding to help middle-class students attend the University of California or California State University. The maximum scholarship amount will vary depending on family income, assets, and other financial aid awards. For students with family income up to $184,000, and household assets of no more than $184,000: MCS will cover between 10 percent and 40 percent of systemwide tuition and fees.

Blue and Gold Opportunity Plan (UC only): UC's Blue and Gold Opportunity Plan will ensure that you will not have to pay UC's tuition and fees out of your own pocket if you are a California resident whose total family income is less than $80,000 a year and you qualify for financial aid. Blue and Gold students with sufficient financial need can qualify for even more grant aid to help reduce the cost of attending.

Middle Class Scholarship Program

Blue and Gold Opportunity Plan

Federal Grants:

Pell Grant: Pell Grants are awarded to students with demonstrated financial need who haven't earned a bachelor's, associates, or professional degree.

Federal Supplemental Educational Opportunity Grant (FSEOG): The FSEOG program is administered directly by the financial aid office at each participating school. Not all schools participate. Check with your school's financial aid office to find out if the school offers FSEOG.

Teacher Education Assistance for College and Higher Education (TEACH) Grant: A TEACH Grant is different from other federal student grants because it requires you agree to complete a teaching service obligation as a condition for receiving the grant. If you don't complete the service obligation, the grant will be converted into a loan that you must repay with interest.

Student Loans

Federal Student Loans: There are several federal student loan types including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans. Each loan type has limitations on who can take out the loan and under which circumstances. Access the links below for information on these loans as well as federal loan repayment.

Federal Student Loan Repayment

Private Student Loans: Private student loans are an option for individuals who need additional funding that cannot be met through other means. These loans are offered by banks, credit unions, and online lenders.

Veteran Benefits: If your parent is a Veteran, you may qualify for VA Education Benefits for Survivors and Dependents. Follow the link below for more information. If you need assistance in navigating this process, contact your local Veteran Service Office (VSO).

CalVet Tuition Fee Waiver — This program, available to eligible California residents who are dependents of veterans, waives mandatory systemwide tuition and fees at UC. Students should contact their County Veteran Service Office to apply. To determine eligibility, students should reach out to the VA through va.gov, the GI Bill Hotline or your County Veteran Service Office located throughout the state.

Financial Aid Appeals: Were you not awarded financial aid that you believe you should have received? Are there extraneous factors that were not taken into consideration when you applied for financial aid? You may consider filing a financial aid appeal. Schools have a procedure to follow for these appeals, but you may also utilize a service like Swift Student: